Download Free Epc Dental Programs Medicare

- Download Free Epc Dental Programs Medicare Supplement

- Medicare Epcs Requirements

- Download Free Epc Dental Programs Medicare Plans

- Epcs Medicare Part D

Enroll in Medicare directly and select an original Medicare Plan with Medicare Supplemental insurance, or a Medicare Advantage Plan for your medical/prescription drug coverage. Step 3: When you receive your Medicare card, send a copy to the EPC Admin Office at epc. CMS Form 855i is used to enroll in Medicare in order to provide Part B covered items and services. According to the Center for Medicare and Medicaid Services (“CMS”), “Physicians, non-physician practitioners, and other Part B suppliers must enroll in the Medicare Program to get paid for the covered services they furnish to Medicare beneficiaries. Payment of Medicare benefits. The major elements of Medicare are contained in the Health Insurance Act 1973, as amended, and include the following: a. Free treatment for public patients in public hospitals. The payment of 'benefits', or rebates, for professional services listed in the Medicare.

EPC Benefit Resources is committed to supporting you and your church benefits staff as you transition to Medicare.

TRICARE Dental Program 1-844-653-4061 (CONUS) 1-844-653-4060 (OCONUS). Premium-free Medicare Part A at age 65 if you or your spouse has 40 quarters or 10 years.

Your ability to retain your current EPC Medical/Prescription Drug benefit or obligation to obtain coverage through Medicare is driven by the size of the staff employed by your church/ministry. For starters, if you are employed full time in a church with a larger staff, you will continue to receive your church-provided EPC medical/prescription drug benefits and there will be no change to your EPC-provided coverages. If you are employed by a church with fewer than 20 “full-time equivalent” staff, then you will need to transition to publicly available Medicare and Medicare Supplement coverages (including prescription drug coverage) as of your eligibility date and should begin exploring options in the public marketplace. See below for more information on determining whether your church may qualify as a large or small employer.

It is important to note that your transition to coverage through a publicly available Medicare Plan does not impact the EPC’s commitment to the provision of medical benefits. If the benefits provided through your church or ministry in your Terms of Call include the provision of medical benefits, the cost of your Medicare premiums while actively employed will still be paid by your church through reimbursement of the premiums you pay.

Use these quicklinks to navigate to the appropriate section of this page:

Employees of Larger Churches (20+ Employees)

Employees of Smaller Churches (<20 Employees)

Additional Resources

For more BRI information, see the following pages (which also are available from the Resources > Benefits menu above):

About Benefits

2021 Medical/Prescription Drug Plans

2021 Dental Plans

2021 Vision Plans

Other 2021 Benefit Plans

2021 Health Savings Account

2021 Wellness Program

Retirement Plan

Housing Allowance for Retired Ministers

Medicare Enrollment Planning

Church Administrator Resources

2020 Benefits Information

Medicare Coordination of Benefit Rules require Large Employers that provide medical benefits to continue providing the Primary coverage to Medicare eligible full-time employees. Your church’s Benefit Administrator can tell you if your church is obligated to provide benefits to Medicare eligible employees or covered spouses aged 65 or older. If that is your situation, your church-provided benefit will continue and be your primary coverage if you remain a full-time employee (at least 30 hours per week). There will be no change to your current EPC Medical and Prescription Drug Plan coverage.

Even if you are employed by a large employer, you should still enroll in Medicare A when you become eligible because Medicare may pay benefits as a secondary payor to make up the difference between your employer-provided benefits and Medicare benefits, if your employer-provided benefits are less than what would be covered by Medicare.

Three months prior to you becoming Medicare eligible, your church administrator will receive an email from our BRI Admin Office with a copy of the Large Employer Certification Form (LECF), also available below. Your Church Administrator will complete the LECF and return to the BRI Admin Office at epc@cdsadmin.com or fax to 412-224-4465. This form confirms the Large Employer status of your Church so that your church-provided benefit will continue and be your primary coverage if you remain a full-time employee (at least 30 hours per week). To be fully compliant, this form must be submitted prior to the participant turning 65 years of age.

Large Employer Certification Form

This form confirms the Large Employer status of the church. Your employer will complete this form, but it is provided for your reference.

If you are an employee of an EPC church that has less than 20 “full-time equivalent” employees, even as a full-time employee, you will need to enroll in Medicare directly and select an original Medicare Plan with Medicare Supplemental insurance plus a Part D prescription plan; or a Medicare Advantage Plan with prescription drug coverage for your medical/Rx coverage. Upon the commencement of your Medicare coverage at your eligibility date, your EPC provided coverage will be terminated. Please make sure you submit a copy of your Medicare card to our admin office in order to terminate coverage through the EPC.

You should begin to explore available Medicare Plan choices by reviewing the approved Plans in your state and checking their benefit levels and costs (including network doctors and covered medications). You can compare the coverages offered by Medicare Plans with your current EPC coverages to find a Plan that closely matches your current coverages. A general description of Medicare Plans and the Medicare enrollment process with frequently asked questions and links to resources can be found under the Additional Resources section below.

To assist you with making comparisons, all EPC plan documents with coverage descriptions are available on our Medical/Prescription Drug Plans page.

• Original Medicare Plans. Original Medicare consists of Part A (hospital) which is free, and Part B (medical) which is optional and requires a premium payment.

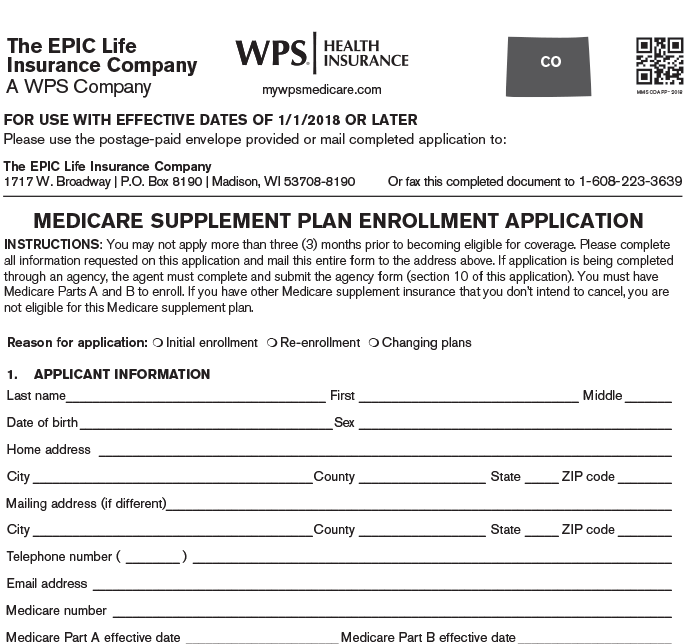

• Medicare Supplement Insurance. Original Medicare coverages are often coupled with private Medicare Supplement Insurance (also called Medigap insurance) that adds additional coverages to original Medicare A and B coverages, plus Medicare Part D prescription drug coverage. Enrollment in Medicare Supplement policies requires additional premium payments. These optional Medicare Supplemental Plans are designed to “supplement” coverages provided by original Medicare. That means once you are enrolled in original Medicare A and B coverages, Medicare pays your eligible claims first as your primary payor and then the Medicare Supplement Policy that you purchase pays all or an additional portion of remaining costs as the secondary payor.

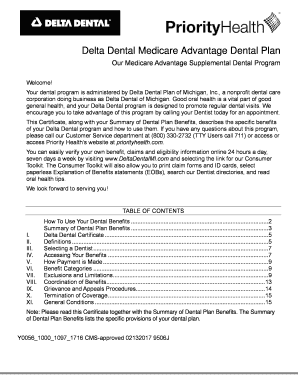

• Medicare Advantage Plans. Medicare Advantage Plans—also called Part C coverage—is your other choice. This coverage is in place of the Original Medicare plus Supplemental Coverages described above; you don’t enroll in both. Part C Plans are available through private insurance companies that are approved and regulated by Medicare and subsidized by the federal government. They combine Part A and Part B—and usually include Part D prescription drug coverages—and act as your sole coverage in place of original Medicare. If you choose a Medicare Advantage Plan it must include prescription drug coverage to maintain the type of benefit coverage you are receiving from the EPC.

To have the complete coverage you are accustomed to with the EPC Medical/Prescription Drug benefit under Medicare, you will need to augment the original Medicare Parts A and B coverage with a Medicare Supplemental Insurance policy, plus a separately purchased Part D prescription drug coverage. Medicare Supplement and Part D coverage providers are approved by Medicare and subject to Medicare regulatory oversight. You will pay additional premiums for these supplemental policies.

Step 1:

Three months prior to your employee becoming Medicare eligible, your church administrator will receive an email from our BRI Admin Office with a copy of the Small Employer Certification Form (SECF), also available below. Your church administrator will complete the SECF and send to the BRI Admin Office as soon as possible. This form confirms the small employer exemption status of the church with the Centers for Medicare & Medicaid Services (CMS). To be fully compliant, this form must be submitted prior to the participant turning 65 years of age.

Step 2:

Enroll in Medicare directly and select an original Medicare Plan with Medicare Supplemental insurance, or a Medicare Advantage Plan for your medical/prescription drug coverage.

Step 3:

When you receive your Medicare card, send a copy to the EPC Admin Office at epc@cdsadmin.com or fax to 412-224-4465. Your coverage through the EPC will be terminated upon receipt of your Medicare card. Please make sure a copy of your Medicare card is submitted within 30 days of your Medicare coverage effective date.

Small Employer Certification Form

This form confirms the Small Employer status of the church. Your employer will complete this form, but it is provided for your reference.

Medicare Eligibility Letter

Instructions for employees who are approaching Medicare eligibility.

FAQs

Handy reference document that provides answers about Medicare medical/prescription drug coverage.

Creditable Coverage Notice

Information about the EPC Medical/Prescription Drug Plan. Letter may be required as proof of creditable coverage when enrolling in Medicare.

These resources were referred to BRI by members on our Plans who have transitioned to Medicare and have found these materials to be helpful.

Seniors Resource Guide

State Health Insurance Assistance Programs (SHIPs) promise local Medicare help with trusted, unbiased, one-on-one counseling and assistance. Each state has a separate website that connects to local partners.

Senior Websites

A directory on www.medicare.gov with links to seven independent resources that provide information and help for Medicare-eligible individuals.

The resources below are commercial insurance agents (licensed brokers) with website and telephone-based services. They offer general orientation/information, compare and quote plans from applicable carriers based on individual demographics, and offer telephone sales and support from qualified agents who can assist with education, choices, and enrollment. These resources were referred to BRI by members on our Plans who have transitioned to Medicare and have found these materials to be helpful.

eHealth

Download Free Epc Dental Programs Medicare Supplement

Find Medicare and Medicare Supplement Insurance plans in your area.

Medicare Epcs Requirements

Medicare Solutions

Medicare Solutions represents many carriers so you’re sure to find a plan right for your budget and needs.

United Medicare Advisors

Unbiased Medicare education and strategies to make signing up for Medicare as simple as possible.

Download Free Epc Dental Programs Medicare Plans

Information provided in this web site does not constitute legally binding advice. EPC benefits are subject to the provisions of the Medical Plan and Retirement Plan documents available on this web site or in print from EPC Benefit Resources, Inc. (BRI), 5850 T.G. Lee Blvd., Suite 510, Orlando FL 32822. For more information, contact BRI at benefits@epc.org or 407-930-4492 (voice and fax).

Epcs Medicare Part D

Office of the General Assembly

5850 T.G. Lee Blvd., Suite 510

Orlando, FL 32822

407-930-4239

407-930-4247 (fax)

info@epc.org